Posts

To include a similar card otherwise cards for the Apple Observe, use the Watch software. Look at the My personal Check out case and you will faucet to your Handbag & Apple Shell out choice. This may offer your wearable an identical strength since your genuine card, which means you’ll manage to pay along with your smartwatch even when their new iphone 4 isn’t nearby. With one to smaller topic to take up to looks high, however some someone require sticking to an excellent ol’ money because of protection concerns. For this reason they’s crucial that you know how app-centered percentage platforms functions and just how they’re able to in reality cover their currency better yet than just a card.

Each one also provides advantages on the cellular telephone repayments, along with additional notable professionals. Whether you employ they to handle your finances, posting money so you can family members or just browse the latest cat memes, their cell phone is likely a majority in your life. Charge card costs are more safer while the there is no-one to intercept the brand new commission. The money happens right from your commission chip into your vendor checking account. Taking percentage from your mobile increases the fresh checkout process because you don’t need adhere just one POS table.

Once again, same as Fruit Pay, the machine will send an authorized token instead of your actual cards details. The technology about software-based payment programs is named Near Career Correspondence. It is a market simple and you may both Bing and you will Fruit fool around with they due to their individual features. This means their cell phone have a tendency to safely shop the cards details and they acquired’t express these with one businesses. If you need to invest whilst you traveling otherwise store around the world on the internet, you may be best off with a wise membership and cards.

Just touch the brand new credit you need to play with immediately after twice-clicking – you will find these bunched right up https://mrbetlogin.com/joker-dice/ at the bottom of your display. Yahoo Spend is quite similar however, was developed from the Google and enables profiles out of each other Android os otherwise ios mobile phones, tablets otherwise observe and make contactless orders. Much like Apple Pay, contain much more to that particular bag than borrowing otherwise debit cards. Fruit Pay are a great contactless means for ios pages and then make payments. They uses biometric testing tech named Deal with ID otherwise Contact ID, or you can play with an excellent passcode to access the newest bag.

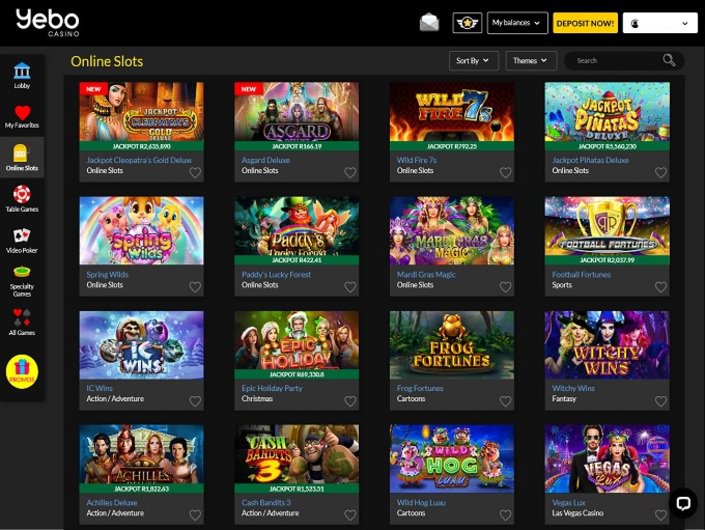

If you get here, only sign in an account because of the completing the desired suggestions. To the Q88Bets Gambling establishment, you are free to enjoy high-quality video game on the ProgressPlay’s excellent program. You will find as much as step one,400 online game regarding the catalog, in addition to real time video game from Advancement.

Expand a corporate.

In spite of the term, Samsung Spend deals with people progressive Android cellular telephone, however, so it accessibility doesn’t translate so you can smartwatches, since the program only operates on the all brand’s very own Universe line. To put it up, down load the new Samsung Shell out application and you may add your own notes. When it’s time to shell out, merely open your own cellular phone using your type of options (fingerprint, face, otherwise PIN), after which hold your device contrary to the critical to use your cards.

The new Apple Cards is a wonderful card option for people who is actually keen on Apple services Apple Pay. The common deposit constraints to have mobile charging try £10-£40 for each put, with all in all, £240 a day. All of our reviews has a huge eco-friendly ‘Gamble HERE’ key that takes your straight to the newest casino.

When you love to apply (and so are accepted) to own a different mastercard due to our site, we might discovered compensation from your partners, and that will get feeling just how or where these materials come. Excite view the advertisements rules and you may unit comment strategy to get more suggestions. Finding the best cards for this function isn’t a facile task since the few personal handmade cards provide an explicit advantages group, as well as smartphone costs. Amazingly, team playing cards tend to give you the better benefits to have using discover monthly obligations such as portable solution.

Consult with your regional transportation agency to understand if this now offers an application using NFC technology to collect journey fares and look at passes. The ways this technology is actually incorporated into public transit often vary because of the area. When you install a cellular bag (otherwise some of him or her) in your unit, you’re also happy to generate payments. The fresh card along with pays 3% cash return for the group of your decision, and airline tickets, rooms, car leases, gas, and you can dinner. It credit and brings dos% cash back to the goods otherwise fuel, and you can step 1% money back everywhere else. Making it a solid find to possess using their cellular phone expenses and you can making perks to the relaxed investing.

- Just in case your travel otherwise store on the internet having around the world retailers, use your credit within the 2 hundred nations to spend for example a neighborhood and you will withdraw at any place.

- We strive to give you information about products you may find intriguing and useful.

- Whenever combined with almost every other Chase notes regarding the Greatest Perks family members, you can transfer those funds to issues if you wish – so it is perhaps one of the most worthwhile notes on the wallet.

- Certain cellular gambling enterprise extra also provides try solely meant for profiles of the brand new mobile adaptation, whether or not very might be accessed because of the anyone.

How can i Faucet-to-Shell out with my Unit?

If you wish to score an improvement out of dated cash and cards however’lso are unacquainted app-centered money, know that they’s as well as easier to score create than you may think. In reality, you really has much of everything you’ll you desire already installed on your cellular phone. The card info aren’t stored on the cellular telephone or view and you may erase your debit otherwise credit card information out of the unit, even if you eliminate they. You’ve most likely seen an electronic Wallet in action, otherwise have the software in your mobile phone, but do you know how to use it? Digital Wallets give comfort by permitting you to definitely make use of cell phone or any other electronic gadgets to pay for anything unlike bucks otherwise your plastic bank card. After that, you’ll need pursue people authentication prompts you can ensure the label.

For Funding You to definitely items noted on this page, some of the advantages is generally provided with Visa otherwise Charge card and may are very different by product. Comprehend the respective Self-help guide to Professionals to possess information, because the words and you can conditions use. What makes which cards special, specifically, ‘s the ability to transfer your own step one.5% cash-to 1.5x Biggest Perks points, providing you have the best mastercard combining.

You can any debit or mastercard in addition to Fruit Cash, boarding seats, experience passes, present cards and much more to the handbag. Apple Spend try extensively approved at the retailers and you can dinner within the industry. Cellular repayments have several levels away from dynamic encryption, leading them to an incredibly safe treatment for shell out. They’lso are more safe than simply magstripe payments and just as the secure since the EMV processor chip cards money. Indeed, for those who’re playing with a mobile costs app having Face ID, including Apple Pay, it’s perhaps more secure than an EMV processor cards fee.

Can i explore a cellular handbag in the an automatic teller machine?

All you manage is actually ring-up a buy, see the brand new environmentally friendly light to look to your Rectangular Viewer, and have the customers hold the cell phone over the tool to help you shell out. Technology you to underpins cellular handbag payments is actually close occupation interaction (NFC). Here is what permits a couple products, such since your cellular telephone and you may a repayments audience to speak without any cables after they’lso are intimate together. Normally, a mobile device must be within this a couple inches out of your readers to help you process the new commission. NFC try a great subset of broadcast-volume identity (RFID), a phenomenon that enables us to select one thing as a result of broadcast surf. RFID has been used for decades so you can see belongings in supermarkets and you will luggage to the baggage says.

But not, the credit cards information that we upload has been written and you may examined by experts who learn these products inside out. I merely strongly recommend issues we sometimes explore our selves or promote. The website doesn’t come with the creditors or all of the available bank card offers that are on the market. Find all of our adverts plan here where we listing entrepreneurs that we focus on, and just how we profit.